work opportunity tax credit questionnaire (wotc)

Work Opportunity Tax Credit Statistics for Louisiana. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Eta Form 9061 Fill Out Sign Online Dochub

Completing Your WOTC Questionnaire.

%20how%20to%20claim%20it%20for%20my%20business.png)

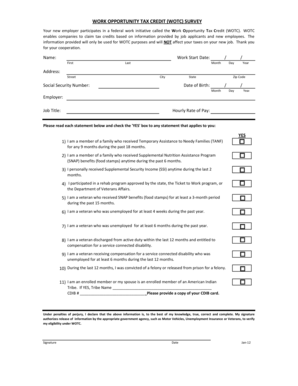

. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training. For detailed information about Georgias WOTC Program contact us. WOTC Work Opportunity Tax Credit Questionnaire K S Staffing Solutions Inc.

April 27 2022 by Erin Forst EA. More information about the Work Opportunity Tax Credit can be found on the US Department of Labors WOTC Homepage. Ad Tap into People Powered Data and start gathering real-time feedback at scale.

If so you will need to complete the questionnaire when you. WOTC Work Opportunity Tax Credit is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. The WOTC is a firm-level tax credit intended to help workers from certain disadvantaged groups get jobs.

Completing Your WOTC Questionnaire. The Work Opportunity Tax questionnaire is the first page of IRS Form 8850. In 2021 the state of Louisiana issued 54173 Work Opportunity Tax Credit certifications.

The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL. Employers generally can earn a tax credit equal to 25 or 40 of a new employees first-year wages up to the maximum for the target group to which the employee belongs. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically.

Get the most out of the Work Opportunity Tax Credit WOTC. The credit for all eligible employees who work between 120 and 400 hours is 25 of their qualified first-year wages up to the maximum amount allowed according to their group. Work Opportunity Tax Credit questionnaire.

What is a Work Opportunity Tax Credit questionnaire. In some cases employers may elect not to claim the WOTC. If your Power of Attorney POA document for the Work Opportunity Tax Credit is expiring at the end of 2022 Lisa and Sean will be reaching out to you to renew over the next.

Work Opportunity Tax Credit Questionnaire. Ad Tap into People Powered Data and start gathering real-time feedback at scale. It asks the applicant about.

Page one of Form 8850 is the WOTC questionnaire. Is participating in the WOTC program offered by the government. There are 10 targeted groups which include certain veterans.

Please take this opportunity to complete an additional applicant assessment. The Work Opportunity Tax Credit WOTC can help you get a job. Online with Work Opportunity Tax Credit Online eWOTC Enroll in Employer Services Online.

Create surveys polls quizzes in minutes with our expert-written templates. We would like you to know that although this questionnaire is. The Work Opportunity Tax Credit is a voluntary program.

What is the Work Opportunity Tax Credit questionnaire. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Create surveys polls quizzes in minutes with our expert-written templates.

A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit program as directed by the Federal government. It is used to determine whether the employee. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the.

If you are in one of the u201ctarget groupsu201d listed below an employer who hires you could receive a federal tax. The Pelican State issued 260 of all. The maximum WOTC credit available for summer youth employees is 1200 per employee.

If so you will need to complete the questionnaire when you. The program has been. Tap our proprietary technology to help simplify the process identify more WOTC eligible employees and capture more tax.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. The WOTC is available for wages paid to certain individuals who begin work on or be See more. If you have already enrolled log in to use eWOTC.

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questions Are Employees Required To Fill Out Wotc Form Cost Management Services Work Opportunity Tax Credits Experts

Employment Incentives Work Opportunity Tax Credit

Common Questions And Answers About Work Opportunity Tax Credits Myventurepad Com

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc 101 What Employers Need To Know About The Work Opportunity Tax Credit

Fillable Online Work Opportunity Tax Credit Wotc Survey Fax Email Print Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Integration For Icims Icims Marketplace

How To Make Wotc A Part Of Your Onboarding Process Irecruit Applicant Tracking Remote Onboarding

Wotc 101 What Employers Need To Know About The Work Opportunity Tax Credit

Peoplematter Tax Credit Process Fourth Hotschedules Customer Success Portal

Completing Your Wotc Questionnaire

An Employer S Work Opportunity Tax Credit Wotc Guide

What You Should Know About The Work Opportunity Tax Credit

Work Opportunity Tax Credits Wotc Walton

Work Opportunity Tax Credit Can Help Businesses Meet Staffing Needs Save On Taxes Don T Mess With Taxes